Author: Frank, Maiton MSX

Tom Lee and Jack Yi (Yi Lihua) probably haven't been sleeping well these past couple of days.

After all, if one were to choose the most dramatic protagonist for the early 2026 crypto market, it probably wouldn't be Bitcoin, nor some groundbreaking new narrative, but these two publicly roasted ETH "whales".

Onlookers never think a funeral is too big an affair.

These days, global investors are holding their breath, collectively watching the largest and most transparent batch of openly long positions in Ethereum's history struggle to survive amidst floating losses.

I. ETH 'Whales' Are Already Floating Losses of Tens of Billions of Dollars

The years repeat similar events, but the 'whales' change each time.

The term "whale," in the Web3 context, typically refers to institutions or individuals with substantial capital足以影响市场走向.

But in recent years, the positive connotation of this word has been continuously diluted by reality, morphing into not just a heavyweight presence, but more like the most visible, and easiest to spectate, target during extreme market volatility.

Over the past few days, the two most discussed ETH "whales" have been Tom Lee's BitMine (BMNR.M) and Jack Yi's (Yi Lihua) Trend Research. Although both are Ethereum (ETH) bulls, they represent two截然不同的 paths: the former is the treasury holding the most ETH, while the latter is an investment机构 openly adding leverage on-chain and publicly going long on ETH.

First, look at BitMine.

As one of the most representative Ethereum reserve companies, BitMine once高调 proposed a long-term goal to acquire approximately 5% of Ethereum's total supply. As of writing, the company has accumulated holdings of 4,285,125 ETH, with a market value接近 $10 billion.

According to ultra sound money statistics, the current total Ethereum supply is approximately 121.4 million coins, meaning BitMine has directly locked up about 3.52% of the circulating ETH supply. The pace of fulfilling this vision is nothing short of aggressive.

Remember, it was only after completing a $250 million private financing round in July 2025 that it officially initiated its "Ethereum Treasury" shift. That is, in less than half a year, BitMine completed the leap from a Bitcoin mining company to the world's largest ETH holder.

Source:ultra sound money

More notably, even as ETH broke below $3000 last week during the accelerating market collapse, BitMine chose to add positions against the trend, buying an additional 41,787 ETH (approx. $108 million) at around $2601, showing steadfast holding conviction.

But the problem随之而来—cost. Conviction has a price. BitMine's average ETH holding cost is approximately $3837, meaning that after ETH fell to around $2350, its paper losses have widened to about $6.4 billion.

This extremely aggressive "coin-based" transformation has also上演了一场极其癫狂的估值博弈 in the US stock secondary market.

Looking back to July 2025, when BitMine first began disclosing its Ethereum acquisition strategy, its stock price (BMNR.M) hovered around $4. Subsequently, the stock price completed a leap from the floor to heaven within half a year, reaching a high of $161, becoming the most dazzling "Ethereum shadow stock" in the global capital markets.

However, succeed with Ethereum, fail with Ethereum. As the ETH price deeply retraced, the premium bubble of BitMine's stock price rapidly burst, and it has now plummeted to $22.8.

If BitMine represents the long-term spot path of trading time for space, then Jack Yi's Trend Research chose another, significantly riskier road.

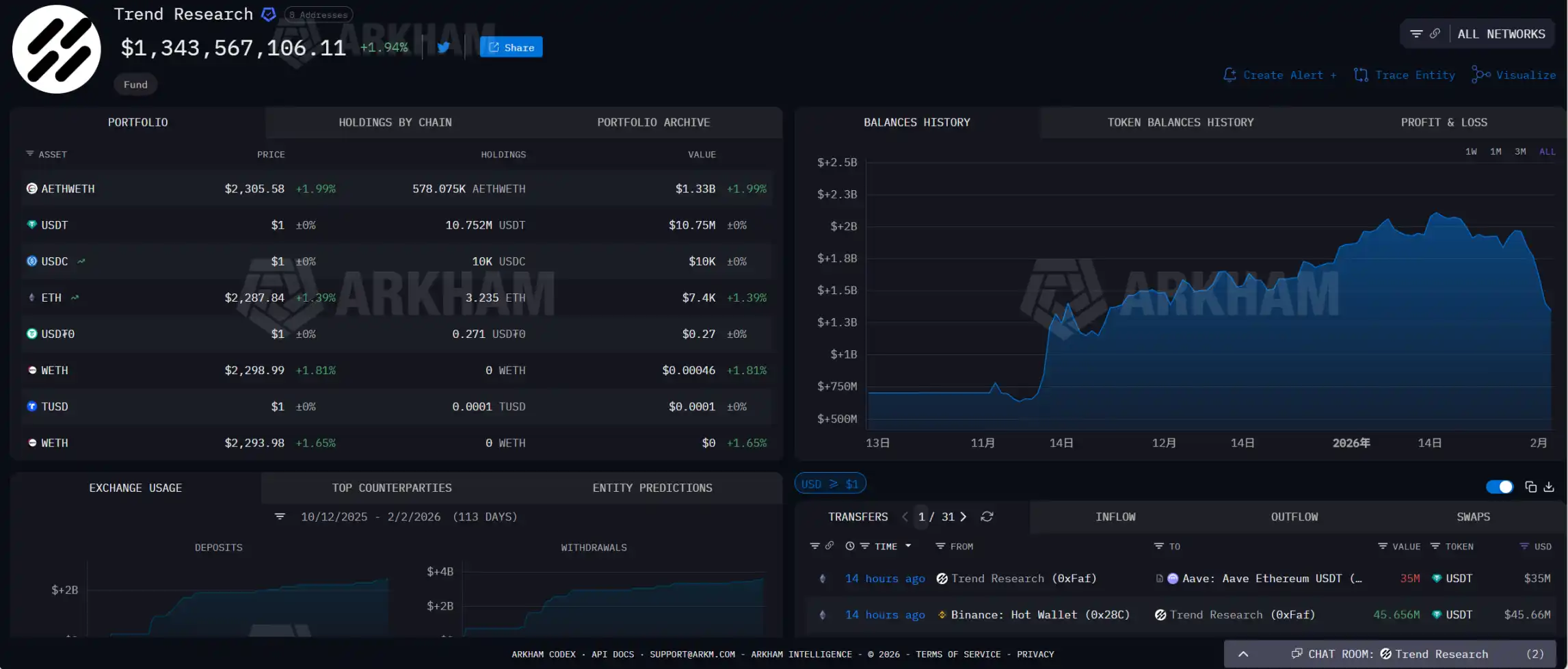

Since November 2025, Trend Research has旗帜鲜明地 publicly gone long on ETH on-chain. Its core strategy is a typical "staking-borrowing-buying-restaking-borrowing" loop:

- Stake held ETH into the on-chain lending protocol Aave;

- Borrow the stablecoin USDT;

- Use the USDT to buy more ETH;

- Continuously循环 to amplify long exposure;

The actual logic of this operation is not complicated; it essentially uses existing ETH as collateral to borrow funds to buy more ETH, betting on leveraged gains during price increase.

This is undoubtedly a highly lethal strategy in a favorable market, but the risk stems precisely from this. Once the ETH price falls, the collateral value shrinks, the lending protocol will require additional margin, otherwise it will trigger forced liquidation, selling ETH at market price to repay the debt.

So when ETH plummeted from around $3000 to a low of approximately $2150 in just 5 days, this mechanism was forced into a "stress state." The chain随即呈现出一种颇具戏剧性的 "death by a thousand cuts"奇景:

To prevent positions from being forcibly liquidated, Trend Research continuously transferred ETH to exchanges, sold it for USDT, and then deposited the USDT back into Aave to repay loans, barely lowering the liquidation line and buying breathing room.

As of February 2nd, Trend Research had deposited 73,588 ETH (worth approx. $169 million) in multiple transactions to Binance for sale and loan repayment. The total loss on its ETH borrowing positions reached $613 million, including realized losses of $47.42 million and floating losses of $565 million. It currently still carries stablecoin leverage loans of approximately $897 million.

Especially during ETH's rapid descent through the $2300-$2150 range, the entire network was almost watching this "stop-loss survival" drama unfold in real-time—every ETH sold by Trend Research was both buying itself survival space and inadvertently handing new selling pressure to the market, tightening the noose around its own neck.

In other words, Trend Research almost killed itself.

Source:Arkham

II. The 'Fire and Ice' Dichotomy Between On-Chain and Off-Chain

The吊诡 thing is, if we temporarily step back from the whales' tens of billions in paper losses and look at Ethereum from an on-chain structure rather than price itself, we find a reality almost opposite to secondary market sentiment—ETH on-chain is持续走热.

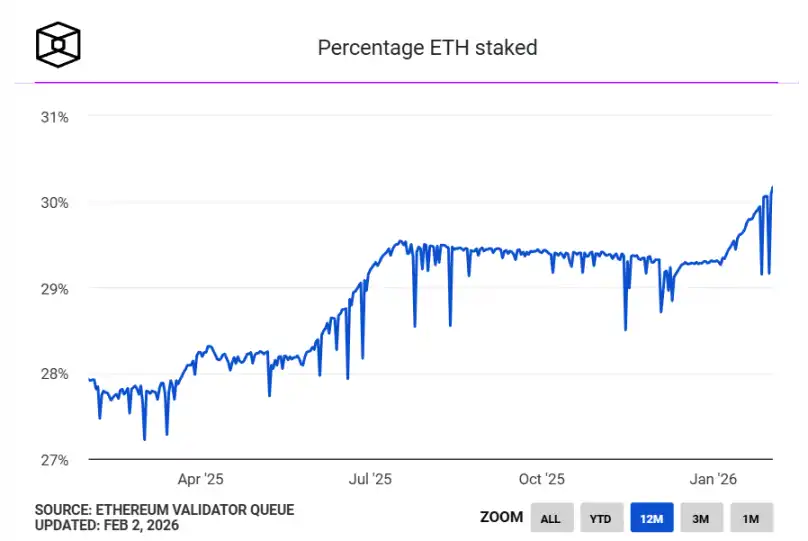

The Block statistics show that approximately 36.6 million ETH are currently staked on the Ethereum Beacon Chain, exceeding 30% of the network's circulating supply, hitting a new historical high.

Note that the previous staking rate record was 29.54%, set in July 2025. This round marks the first time Ethereum's staking rate has substantially crossed the 30% threshold since entering the PoS era.

Source:The Block

From a financial supply and demand structure perspective, this change is highly significant.

A large amount of ETH being staked means it has actively exited the free流通 market,剧烈转型 from a "speculative currency" used for high-frequency trading and speculation into an "interest-bearing bond" with productive properties. In other words, ETH is no longer just Gas, a medium of exchange, or a speculative tool, but is increasingly扮演一种 "means of production" role—participating in network operation through staking and continuously generating yield.

Of course, heavyweight players like BitMine are part of this—BitMine has staked nearly 70% of its held ETH (approx. 2,897,459 coins) and is continuously adding more.

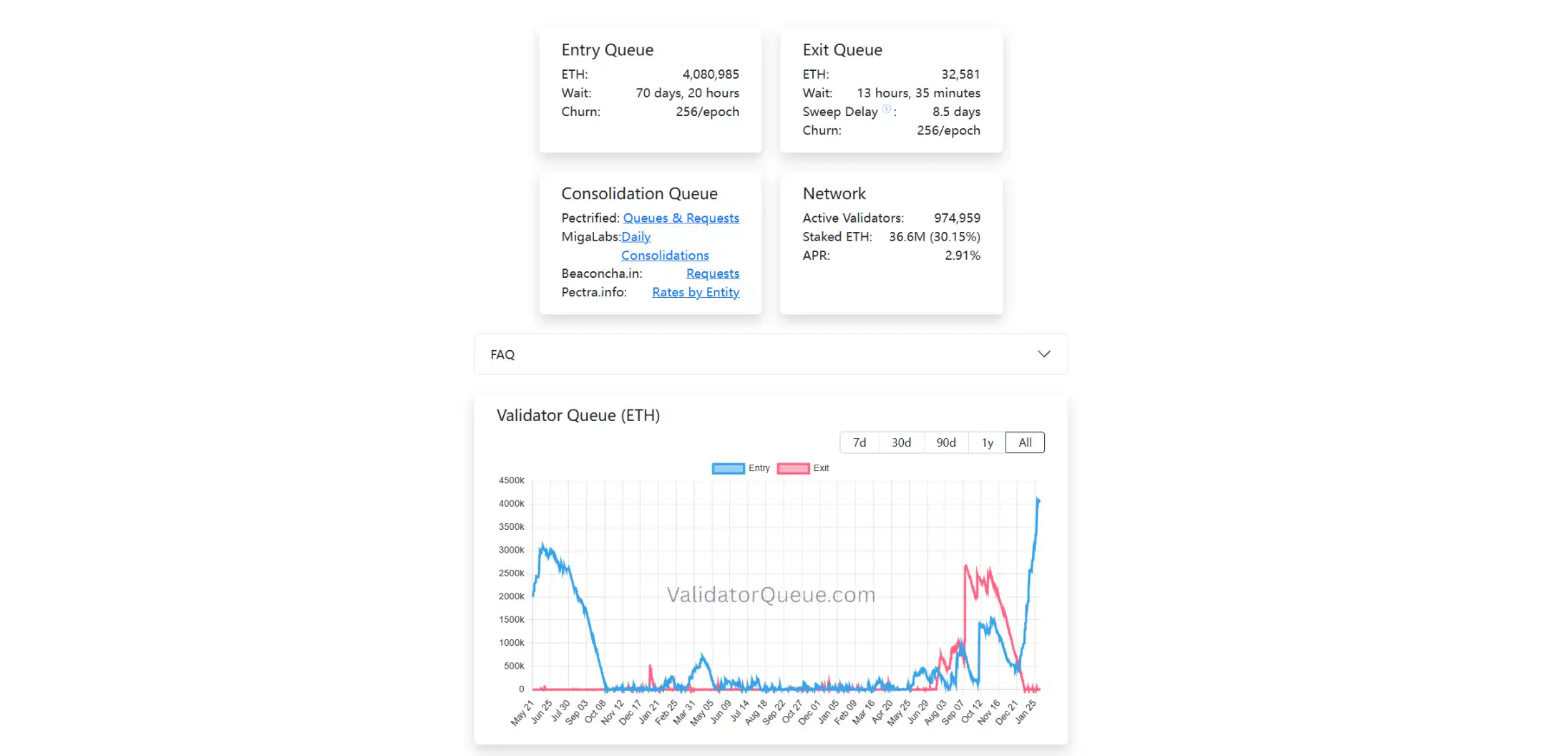

Simultaneously, the validator queue has seen微妙的变化. The exit queue is nearly empty, while the entry queue for staking continues to lengthen, with over 4.08 million ETH排队等待 "entering." In short, the current state is "exiting is smooth, but entering requires a 7-day wait."

This queue size has set a new high since the launch of Ethereum's PoS staking mechanism. And from a time dimension, the steep rise of this curve恰恰始于 December 2025.

This also coincides with the beginning of Trend Research's openly aggressive long positioning on ETH.

Source:Ethereum Validator Queue

It's important to emphasize that, unlike trading, staking is a low-liquidity, long-cycle配置方式 emphasizing stable returns. After all, once funds enter the staking queue, they意味着 giving up the possibility of flexible position adjustment and short-term speculation for a considerable time.

Therefore, as more and more ETH chooses to re-enter the staking system, it at least sends a clear signal: at the current stage, more and more participants are willing to accept long-term locking,主动承担 opportunity costs, in exchange for确定性 on-chain收益.

Thus, a highly tense structural picture emerges. On one side, nearly 1/3 of ETH is being continuously "hoarded," with源源不断的 ETH waiting off-field to be locked up; on the other side, secondary market liquidity is tightening, prices are under持续 pressure, whales are forced to stop losses, and positions are frequently exposed.

This clear divergence between on-chain and off-chain constitutes the most vivid "fire and ice" picture in the current Ethereum ecosystem.

III. The Openly Declared 'Whale,' Already on the Menu?

In traditional financial games, the cards are often not公开透明的. Things like position size, cost basis, leverage ratio, etc., can be hidden within tools like derivatives, OTC protocols, leveraging information asymmetry.

But on-chain, every transfer, every抵押, every liquidation line of a whale is exposed 24/7 to the entire market's view. Once you choose to openly declare a long position, you easily fall into a体力消耗战 of "proving Murphy's Law."

So from a game theory perspective, although Tom Lee and Jack Yi are both bulls and both have declared their hands, they stand at opposite ends of the risk curve.

Tom Lee, despite a $6.4 billion paper loss, BitMine chose a "low leverage, high staking, zero debt" spot path. As long as no structural risk is triggered, he can choose to hold (HODL) within the time window, letting staking收益 slowly hedge the volatility.

The facts are indeed so. Contrary to most market imaginations, BitMine's structure is not激进. As Tom Lee emphasized in a social media post on February 2nd: They have $586 million in cash reserves, and 67% of their ETH is staked, generating over $1 million in daily cash flow. For him, the drop is just a缩水 of paper numbers, not the降临 of a survival crisis.

Jack Yi, however, added leverage through Aave's循环贷, thus陷入 the negative loop of "price drop - approach liquidation line - transfer ETH to sell - add margin - price drops again." This is like a全网围观 "performance art."

The shorts don't necessarily need to liquidate you; they just need to suppress the price → force position reduction → create passive selling pressure → trigger follow-on selling to complete a structural hunt.

This is why every repayment, every transfer by Trend Research is放大解读 as a sign of Jack Yi's confidence waning, whether he is about to capitulate. As of writing, Trend Research has stop-loss sold 73,588 ETH (worth approx. $169 million), and the liquidation price for its borrowing positions has been lowered to below $1800.

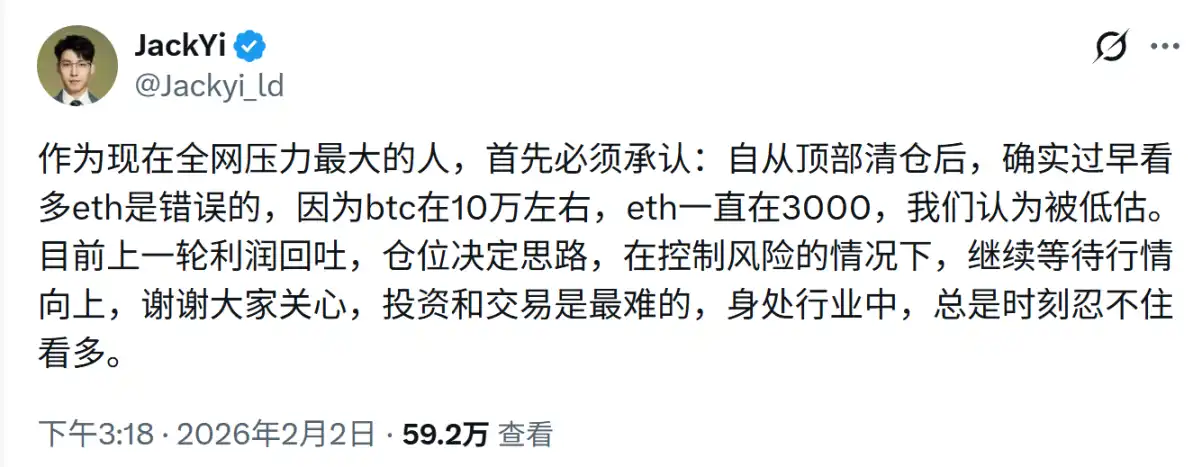

On the same day Tom Lee posted, Jack Yi also publicly reflected: As the person under the most pressure on the entire network right now, I must first admit that being bullish on ETH too early was a mistake... Currently, the profits from the last round have been given back. While controlling risk, I will wait for the market to move upward.

Ultimately, using on-chain循环贷 to go long is equivalent to laying your cards open for everyone to see. Whether there is truly organized targeted killing or not, when you publicize your position size, cost, leverage ratio, and liquidation line on-chain, you have already placed yourself on the sniper list of all共振 forces in the market.

Of course, to some extent, this is also a form of path dependency. After all, in April 2025, Jack Yi publicly called for going long on ETH when it fell to $1450, continuously added positions, and ultimately welcomed a rebound and profits, once becoming a "spiritual banner" for ETH bulls.

It's just that this time, the story's direction remains unknown, and Tom Lee's chances of winning are clearly greater.

In Conclusion

From Three Arrows Capital to FTX, to the now publicly spectated BitMine, the script never changes: all collapses begin with excessive arrogance regarding long-term certainty.

As Keynes's overused quote goes: "In the long run, we are all dead." Jack Yi's mistake was not in being long-term bullish on Ethereum, but in underestimating the残忍程度 of the market in its short-term irrational phases. From the moment he chose to openly add leverage, he had already sacrificed himself to this transparent algorithmic world.

But looking at it from another angle, this might be a necessary "great cleansing" for Ethereum. Every cycle needs such a whale fall process: whales being围观, leverage being squeezed out, path dependency being shattered,筹码重新分布.

Only after the necessary losses are stopped, and the necessary holding out is finished, can it truly advance lightly.